This is a showcase for how I solved for a fraud attack in July 2023. I look forward to showing the full case study 1:1.

Problem

Desktop user’s weren’t able to open an account digitally due to a fraud incident affecting approximately 4000 applications during a 47 day period.

Impact

Increased overall pass rate by 12%.

Student banking pass rate increased by over 2X.

Completion rates on desktop computers rose above mobile devices.

Solution

The two methods, Interac Verification Service and Manual entry, were shut down because of fraud.

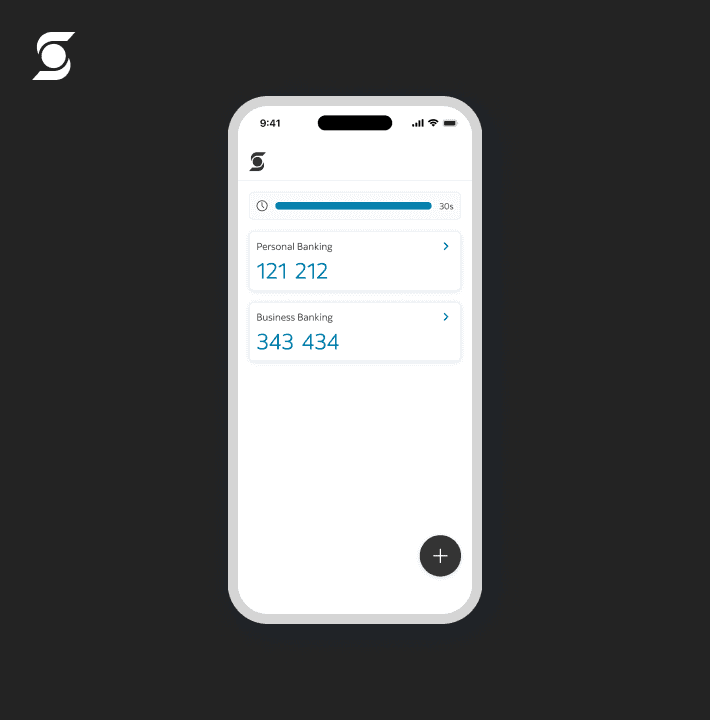

We introduced a method that we already use on mobile, for desktop users'.

This is the new entry for Gemalto (our vendor for photo ID and selfie verification)

Users are transitioned to their mobile device using a QR code.

If people aren't able to scan the QR code, we provide some other suggestions for them to try.

Once the QR code is scanned, we provide some feed back for what the user can expect.

When the instructions on their mobile phone are complete, we transition them back to their mobile device.